by hopsiesites

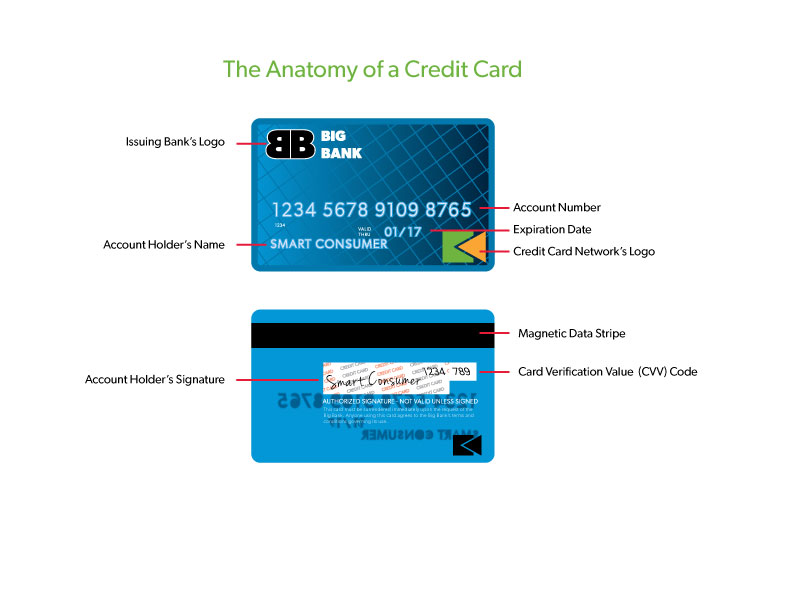

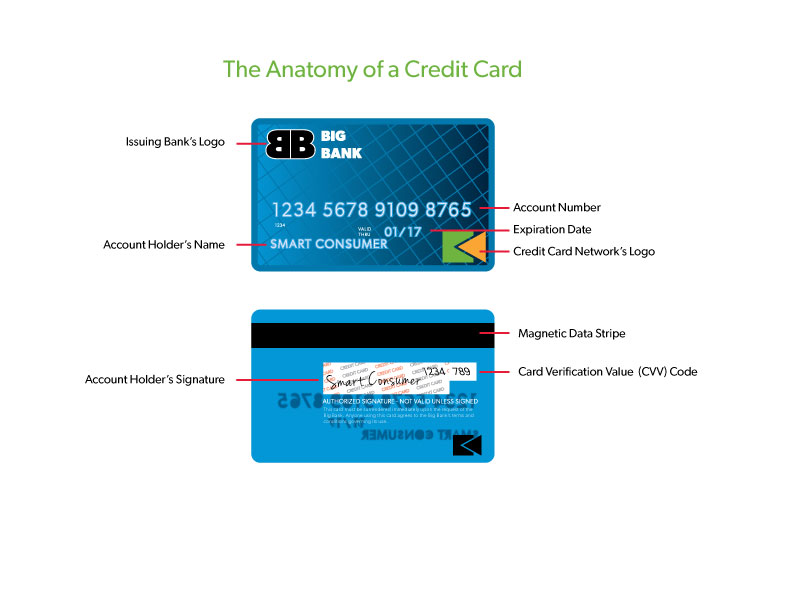

Most people think of a credit card as a little piece of plastic that they keep in their wallets or purses.

When someone wants to make a purchase, but doesn’t have the cash on hand, they can use their credit card. With just a simple swipe and a signature, you can take your purchase home. No cash required.

Credit card users are not limited to buying items in a store. The cards can be used to pay for services and order items online or over the phone. Credit cards can even be used to pay for income and property taxes. You can use your credit card to receive a cash advance, and many credit card companies send you blank checks that you can use to write against your credit card account. Let’s face it, credit cards are downright convenient.

In reality, a credit card is much more than a magic piece of plastic. It is a financial tool that gives you access to a line of credit. That’s right, a line of credit. Every time you swipe a credit card, you are taking out a loan with your credit card provider. Just like any other loan, you are expected to pay the credit card loan back on time. If you carry a balance over from month to month, you can expect interest…lots of interest. You can also expect fees. You will find there are fees for paying late, fees for cash advances and for using those convenience checks (3-4% and a higher interest rate). Want to transfer a balance from one credit card to another? There is probably a 3% fee on the balance transfer as well.

If used correctly, a credit card can be convenient and rewarding. You can build and maintain a good credit score using a credit card. You can earn points for vacations and cool gadgets. Some credit cards even offer cash back on purchases you make with the card.

On the other hand, the money you spent on that convenience and all of those vacations, toys, and other perks are going to bite you hard if you abuse your credit cards. How can you misuse your credit cards? You also misuse them by using them to live beyond your means, by failing to pay off your balances, or by only making minimum payments. The worst way you misuse a credit card is to not make your payments on time. If you don’t manage your credit cards well, late fees and interest rates will go up as fast as your credit score goes down.

As with any tool, credit cards are not inherently bad. It’s how you misuse your credit card that can lead you into trouble. When contemplating using a credit card, you might ask yourself some questions. Can I afford to pay for this when the bill comes due? Does this purchase fit into my overall spending plan? If the answer is no to either question, then you should think twice before using your credit card.

Share this article